How do the European Green Deal and regulatory changes affect the valuation of energy-sector companies?

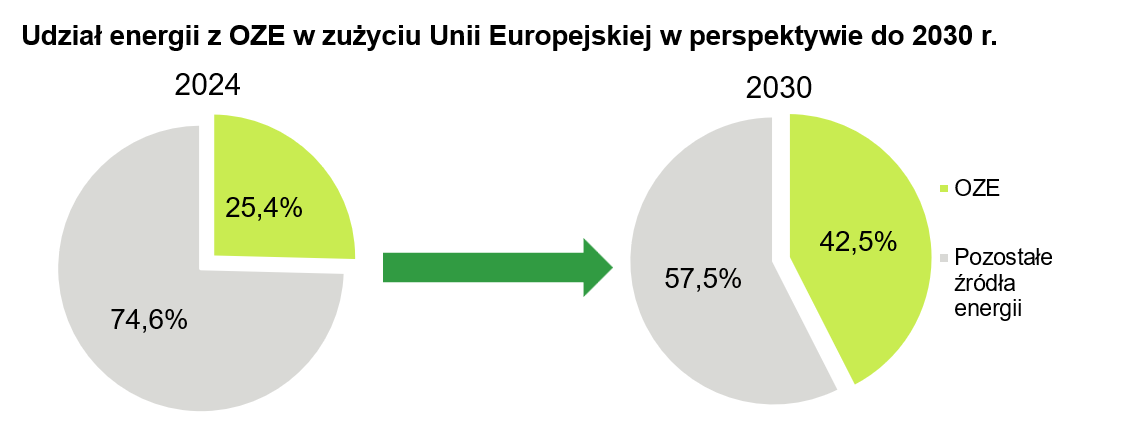

The European Green Deal, and in particular the Fit for 55 package, sets new climate targets: a reduction of CO₂ emissions by at least 55% by 2030 and an increase in the share of renewable energy sources (RES; Polish: OZE) in the energy mix. For energy companies, this means revisiting their strategies—transforming the energy mix, modernising assets and adjusting financial models.

Regulatory changes

Among the regulatory changes introduced by the Green Deal, the most important for the energy market are:

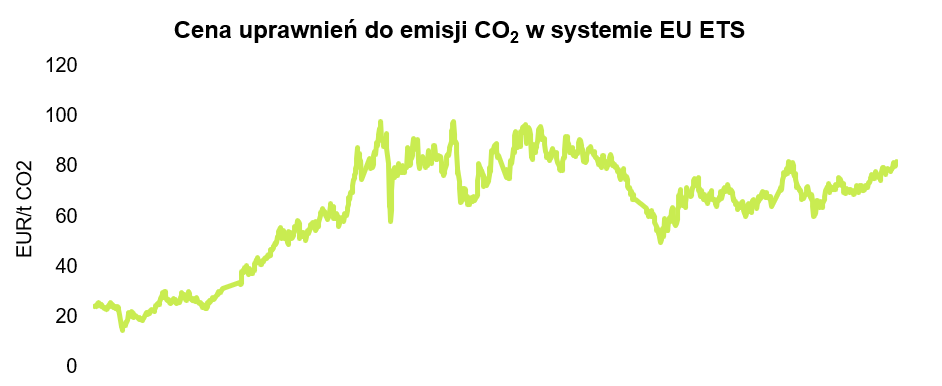

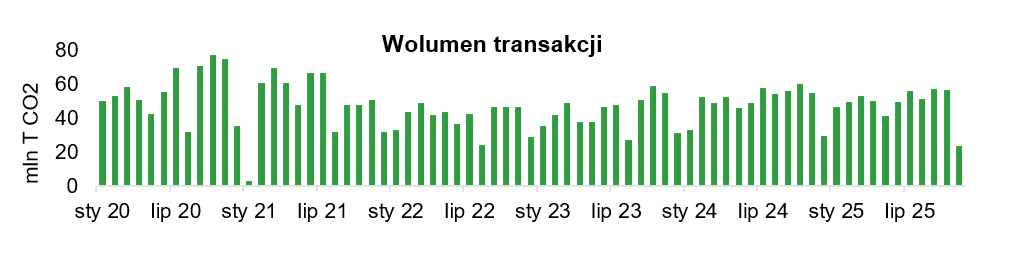

Tightening of the EU ETS (European Union Emissions Trading System). EU ETS prices rose sharply to EUR 80–90/t in 2021–22, which significantly increased costs for coal-based companies. In addition, from mid-2025, sources emitting more than 550 g CO₂/kWh are no longer eligible for support under the capacity market.

In November 2025, by way of an EU climate law regulation, the introduction of ETS2—extending emissions allowance trading to transport and buildings—was postponed from 2027 to 2028.

The introduction of the Fit for 55 package, which requires EU Member States to change their energy mix, in particular to reach a 42.5% share of RES in energy consumption by 2030. To adapt the economy to these new requirements, substantial investment in the heating sector is needed, estimated at USD 70–105 billion.

The EU Taxonomy, a system developed by the European Union that defines which economic activities can be considered environmentally sustainable in the context of the European Green Deal. Under the EU Taxonomy, companies must disclose the share of capital expenditures and operating expenses attributed to the separate “taxonomy-aligned” category in total expenditures.

A financial instrument intended to help the EU achieve its climate goals is international carbon credits. They make it possible to offset one’s own emissions by purchasing credits linked to green projects implemented in third countries. In November 2025, the Danish Presidency of the Council of the EU proposed that carbon credits could account for 3% of the total reduction effort in 2036. Many countries wanted a higher share, including Poland—10%. Setting the share of carbon credits at 5%, with an option to extend by a further 5%, opens the way for the required EU emissions reduction by 2040 to be 80% rather than 90%.

Implications for the valuation of energy companies

The introduction of the above regulatory package will have a fundamental impact on the market value of energy companies; however, depending on a company’s generation profile, the direction and magnitude of valuation changes will differ.

The group that will be affected most negatively by the introduction of the Green Deal are coal companies. Regulatory tightening will increase the cost of CO₂ emission allowances and reduce access to both domestic and EU subsidies. As a result, these companies become less profitable, which translates into lower market valuations. Given the deteriorating outlook for coal assets, various options are being considered, including carving them out of energy companies via state-managed spin-offs and securing long-term support from the government or the European Union.

In a different position are companies focused on producing energy from renewable sources. Given the EU policy’s strong push away from fossil fuels, RES projects are more attractive to investors thanks to lower regulatory risk, EU support and a better ESG (Environmental, Social and Governance) profile. Companies with a growing RES share (e.g., PGE or Energa/OrLEN) can realistically increase value, due to shifting their production structure toward higher-value renewable assets. The scale of these increases depends primarily on the sector companies’ current energy mix and their prospects of obtaining support from the state or the European Union in the context of changing their generation profile and moving away from fossil fuels.

Regulatory changes introduced under the Green Deal create a need to adjust financial models and the valuation of energy assets to the new environment. Expanded financial models must incorporate scenarios such as changes in CO₂ prices, alternative energy-mix pathways and transition costs. To assess valuations effectively, it is also important to run sensitivity analyses of key DCF valuation drivers (discounted cash flow method), such as free cash flows and WACC (weighted average cost of capital), to regulatory changes.

Adaptation measures for energy companies

In view of the many changes brought about by the European Green Deal regulatory package, it is crucial for energy company management boards to take appropriate steps to prepare their organisations for the new reality. Key areas requiring adjustment include:

Scenario analysis

At least three scenarios should be developed: a base case, a pessimistic case (tighter emissions trading conditions, slower RES development) and an optimistic case (strong EU support).

Assessment of alignment with the EU Taxonomy

To achieve a satisfactory level of alignment with the presented criteria, it is important to continuously monitor KPIs (key performance indicators), such as the share of “green” capital expenditures and costs in total expenditures.

Revision of the cost of capital (WACC)

The cost of capital model should be supplemented with a transition risk premium and the ESG profile.

Coal asset strategy

Companies with coal assets should account for the loss of their value, consider phase-out strategies and estimate potential closure or modernisation costs.

Financing and support

An appropriate financing mix should be ensured by using sources such as EU grants (from the Modernisation Fund), EIB (European Investment Bank) financing or the EIC (European Innovation Council).

Practical case study: Polish energy companies

PGE

In October 2020, PGE Polska Grupa Energetyczna published a new strategy through 2030 with an outlook to 2050, along with a transition plan aimed at achieving climate neutrality for the Group by 2050. The key development directions for the PGE Group will be offshore and onshore wind power, photovoltaics, grid infrastructure, low-emission district heating and energy services. The divestment and business-downscaling area will cover coal-based power generation and hard coal trading.

In 2024, the company announced plans to build Europe’s largest energy storage facility in Żarnowiec. It will have a capacity of up to 263 MW and at least 900 MWh. The project is intended to support balancing of PGE’s onshore and offshore wind farms in the Baltic Sea and to improve the stability of the Polish power system.

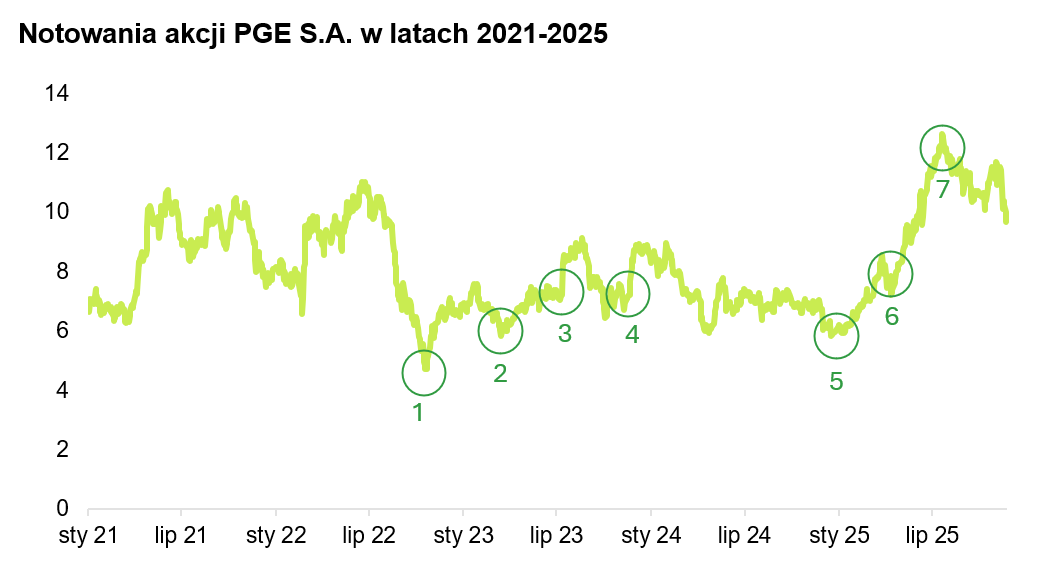

The impact of the most important changes related to the energy transition and RES on PGE’s market share valuation is shown in the chart below.

Preliminary decision of the National Energy Security Agency (NABE) to carve out coal assets.

Signing of the amendment to the 10H Act—the 700 m rule—unlocking the potential for new onshore wind farms; establishment of PGE PAK Nuclear Energy as a long-term growth option.

Receiving from the State Treasury a proposal to purchase coal assets.

Releasing funds of National Recovery Plan (NRP) funds for Poland.

Ørsted and PGE taking the final investment decision on Poland’s largest RES project—Baltica 2 offshore wind farm.

Receiving PLN 12 billion in loans from BGK (NRP).

NABE withdrawing from purchasing coal assets from energy companies.

Orlen/Energa

The European Investment Bank and the ORLEN Group signed a loan agreement worth PLN 900 million to finance projects supporting the energy transition in Poland. The funds will be allocated to investments in the distribution network of Energa Operator, majority-owned by ORLEN. EIB support will allow the strengthening and expansion of the power grid in northern and central Poland, including connecting new renewable energy sources (RES/OZE). This is the first agreement from the total pool of PLN 3.5 billion approved by the EIB to strengthen Energa Operator’s grid in 2024–25.

Under its updated decarbonisation strategy, the ORLEN Group plans to reduce CO₂ emissions in three stages—by 2030 and by 2035—with the goal of achieving “Net Zero” by 2050.

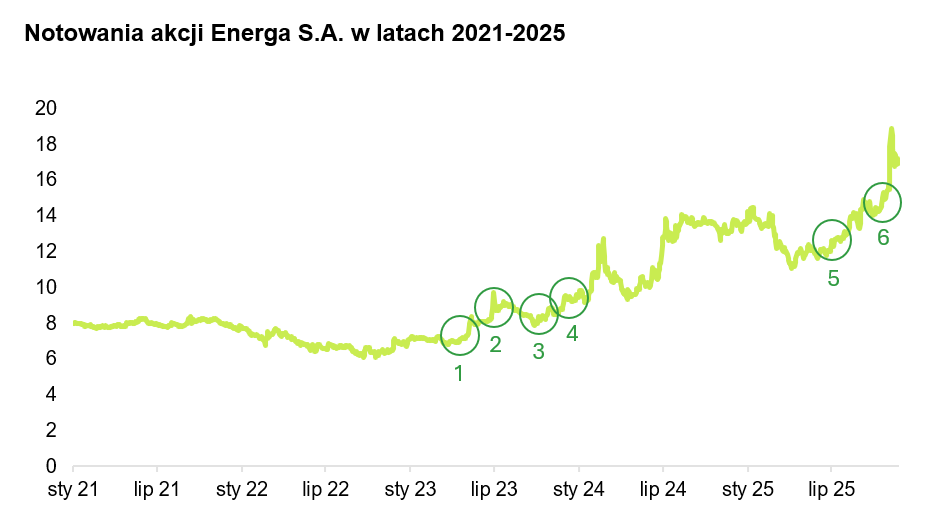

The impact of the most important changes related to the energy transition and RES on Energa’s market share valuation is shown in the chart below.

Signing of the amendment to the 10H Act—the 700 m rule.

Receiving from the State Treasury a proposal to purchase coal assets.

Financial close for the Baltic Power 1.1 GW project.

Releasing NRP funds for Poland.

NABE withdrawing from purchasing coal assets from energy companies.

Enea

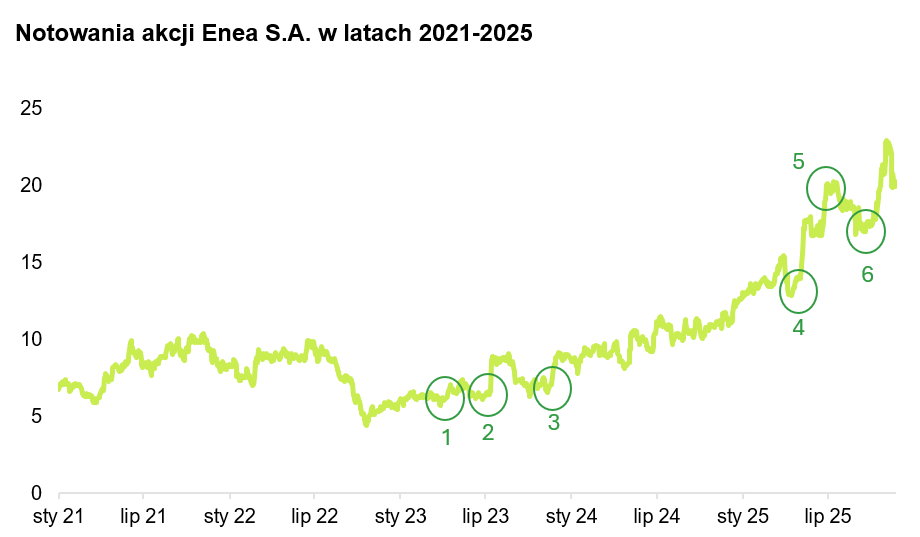

The impact of the most important changes related to the energy transition and RES on Enea’s market share valuation is shown in the chart below.

Signing of the amendment to the 10H Act—the 700 m rule.

Receiving from the State Treasury a proposal to purchase coal assets.

Releasing NRP funds for Poland.

Receiving PLN 9 billion from BGK (NRP).

NABE withdrawing from purchasing coal assets from energy companies.

Increasing the BGK loan (NRP) by an additional PLN 1 billion.

Tauron Polska Energia

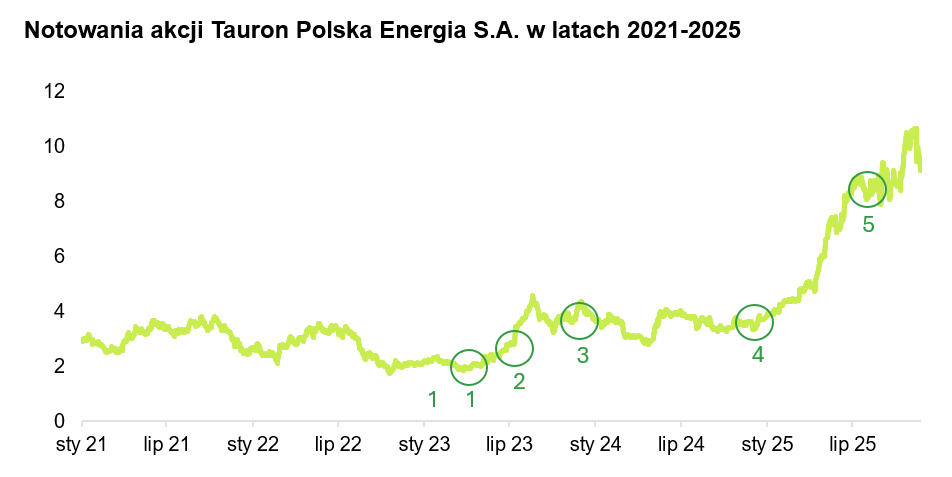

The impact of the most important changes related to the energy transition and RES on Tauron PE’s market share valuation is shown in the chart below.

Acquisition of Tauron Wydobycie by the State Treasury; signing of the amendment to the 10H Act—the 700 m rule.

Receiving from the State Treasury a proposal to purchase coal assets.

Releasing NRP funds for Poland.

Receiving a PLN 11 billion loan from BGK (NRP).

NABE withdrawing from purchasing coal assets from energy companies; an additional PLN 5 billion loan (NRP).

Conclusions

The impact of the energy transition on the valuations of electricity producers and distributors has been most clearly visible in recent years since the launch of preferential loans under the National Recovery Plan (NRP). Both the announcement of the programme’s launch and the acquisition of subsequent financing tranches were met with a positive market reaction and resulted in significant increases in the stock-market valuations of energy companies. Market participants’ reactions were also visible following the government’s decision first to purchase the coal assets of energy companies in July 2023—driving share price increases—and then in the share price declines in July 2025 caused by the abandonment of that plan.

The European Green Deal introduces a range of regulations that affect energy-sector entities in different ways. In the area of valuations and capital, the result is a significant downward adjustment for coal assets and, on the other hand, a premium for RES. To properly reflect the impact of regulations on enterprise value, financial models need to be expanded with regulatory scenarios such as CO₂ prices, taxonomy alignment and emissions trading system conditions. In the area of financing, it should be noted that access to EU funds (Modernisation Fund, European Investment Bank) reduces the cost of capital. The new changes entail higher ESG-related reporting costs; however, as a result, socially responsible and modernised entities build value and increase their market credibility.